PO financing fundamentals utilize Purchase Orders (POs) as collateral for pre-delivery funding, bridging ordering and receipt gaps. This supply chain management strategy offers flexible options like traditional trade credit, stand-alone financing, or Letters of Credit (LCs), catering to diverse business needs. Lenders assess buyer-supplier creditworthiness and goods/service value for eligibility. The right PO financing type, from bank loans to factoring, is chosen based on specific requirements, considering interest rates, fees, repayment terms, and operational flexibility. Effective cash flow management, strategic PO submission timing, reliable supplier selection, meticulous record-keeping, and contract reviews enhance PO financing's overall effectiveness.

Discover the power of PO financing fundamentals and unlock your business’s capital potential. In today’s fast-paced market, understanding purchase order (PO) financing is crucial for cash flow management and fueling growth. This article delves into the essentials, exploring various PO financing strategies and their real-world applications. From types like immediate payment and deferred payment to key considerations and best practices, learn how to maximize this game-changing strategy for your business’s success.

- Understanding Purchase Order (PO) Financing: Unlocking Capital for Businesses

- PO Financing Strategies: Types and Their Applications

- Key Considerations in Implementing PO Financing

- Maximizing PO Financing: Tips and Best Practices

Understanding Purchase Order (PO) Financing: Unlocking Capital for Businesses

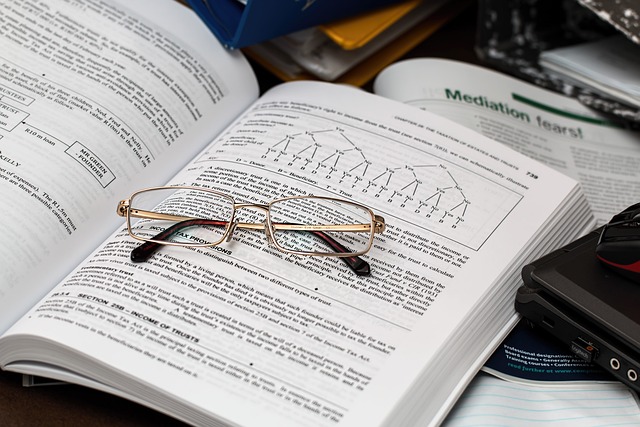

Purchase orders (POs) are a fundamental part of the supply chain process, serving as legally binding documents that initiate the purchase and delivery of goods or services. PO financing, on the other hand, is a strategic approach to unlocking capital for businesses by leveraging these orders. It involves using POs as collateral to secure funding before the goods are delivered, effectively providing working capital to companies in need of immediate financial support.

This strategy offers several advantages, particularly for small and medium-sized enterprises (SMEs) that often face cash flow challenges. By accessing PO financing, businesses can bridge the gap between placing an order and receiving the goods or services, enabling them to manage operations, meet obligations, and seize market opportunities without delays caused by cash constraints.

PO Financing Strategies: Types and Their Applications

Purchase Order (PO) financing strategies are a crucial component of supply chain management, offering businesses flexible funding options to streamline operations and enhance cash flow. These strategies involve utilizing POs not just as orders for goods or services but also as financial tools to secure working capital. PO financing comes in various types, each catering to specific business needs and applications.

One common approach is the traditional trade credit, where suppliers extend credit to buyers based on their reputation and payment history. This strategy facilitates faster purchases and can improve cash flow for both parties. Another type is the stand-alone financing, often used for large or complex projects. Here, financial institutions provide loans specifically backed by the PO, offering businesses a dedicated source of funds without tying up working capital in inventory. Additionally, there’s the letter of credit (LC) method, ensuring payment upon delivery, which adds a layer of security for both the buyer and supplier, making it ideal for international trade.

Key Considerations in Implementing PO Financing

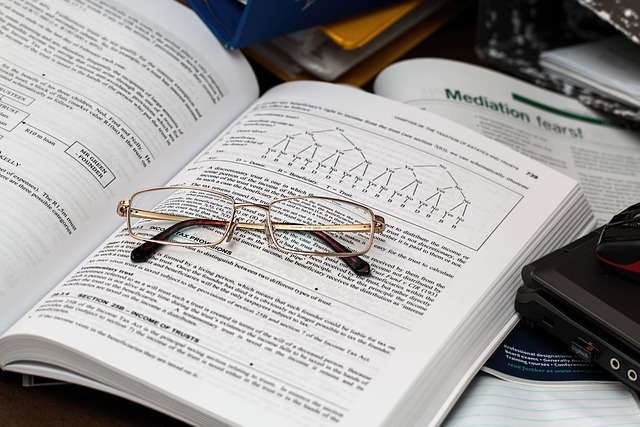

When implementing Purchase Order (PO) financing strategies, several key considerations come into play. First and foremost, understanding PO financing fundamentals is crucial. This involves grasping the basic structure of a PO – a legally binding agreement between a buyer and supplier – and how it can be used as collateral for financing. Lenders assess the creditworthiness of both parties, the supplier’s financial health, and the quality and value of the goods or services being purchased to determine eligibility and terms.

Another vital consideration is the type of PO financing suited for your business needs. Options range from traditional bank loans secured by POs to more innovative alternatives like factoring or synthetic PO financing. Each has its own advantages and drawbacks in terms of interest rates, fees, repayment terms, and operational flexibility. Additionally, businesses must evaluate their cash flow management strategies, ensuring sufficient liquidity to cover operational expenses while maintaining a manageable debt burden from PO financing.

Maximizing PO Financing: Tips and Best Practices

Maximizing PO financing involves understanding the fundamentals of PO financing and implementing best practices. Firstly, businesses should assess their cash flow patterns to determine the optimal timing for submitting purchase orders (POs). Submitting POs near the beginning of a company’s financial cycle can help stretch payments and improve liquidity. Secondly, selecting the right suppliers is crucial; partnering with financiers who offer competitive rates and flexible terms can significantly enhance PO financing efficiency.

Additionally, maintaining thorough records and accurate accounting practices is essential for maximizing PO financing. Proper documentation ensures that all transactions are tracked, making it easier to manage cash flow and identify areas for improvement. Regularly reviewing and negotiating contracts with suppliers can also lead to better pricing and more favorable payment terms, ultimately enhancing the overall efficiency of PO financing strategies.